“Convenience” is our middle name — bank for free anywhere, anytime with your computer, tablet or smartphone.

Online Banking

- Free, 24/7 online account access

- Manage your accounts from just about anywhere

- Conduct several transactions quickly and securely:

- View your balance

- Transfer funds

- Make credit card payments

- And more!

- Save time with fewer trips to the branch

- View images of cleared checks

- Secure and easy-to-use service

Bill Pay

- Accessible via online banking

- Pay one-time or recurring bills with ease:

- Schedule payments in advance

- Set up payment reminders

- Ensure payments are received on time

- Save money on postage costs

- Have all payee information in one, convenient place

- Reduce paper clutter

- More secure than paper billing

- Make more time for yourself with fewer trips to the branch

- Secure and easy-to-use service

Mobile Banking (Remote Deposit feature will be incorporated into this app 10-29-2019)

- Free, on-the-go banking with your mobile device*

- Available to all Chemcel FCU online banking users

- Accessible via mobile browser or free app

- Mobile banking app available for Apple® and Android™ devices

- Manage your accounts from just about anywhere:

- View your current balance

- Transfer funds

- Pay bills

- And more!

- Save time with fewer trips to the branch

- Secure and easy to use

Mobile (Remote) Deposit

NOTE: October 29, 2019 Remote e-Deposit feature will be moved to the main Mobile Banking app and the separate e-Deposit app will be disabled

- Deposit checks 24/7, from anywhere, for free*

- Available to all Chemcel FCU online banking users

- Accessible via free app

- Mobile deposit app available for Apple and Android devices

Please review our Remote Deposit Agreement.

Multifactor Authentication (MFA) - Enhancing your Online Security

We routinely enhance our online security measures to help keep your account safe. MFA is a security system that requires more than one method to verify user’s identity for log in or to perform certain transactions.

Key Takeaways:

- CFCU uses MFA to protect member accounts.

- Your secure access code can be confirmed via text or email.

REMINDER:

One of the keys to MFA is having accurate contact information on file at CFCU so you can authenticate your log in. If we do not have the correct phone number or email, you may not be able to log in to online or mobile banking.

MFA Process:

- If the MFA does not recognize the device or browser or detects uncharacteristic or unusual behavior, an extra layer of security is triggered, requiring you to take additional steps to verify your identity.

- When the MFA does not recognize your device:

- A verification code will be sent to you by text or email that is on file with CFCU

- In most cases, future log ins from a registered device will not require MFA

- After receiving the verification code, enter it in the provided field and click “continue”

Best Practices for Keeping Your Online Accounts Safe:

In addition to the protections CFCU has in place, we encourage you to use these best practices to help keep your online accounts safe. Take a look at your passwords:

- Change your passwords frequently or if you have the slightest suspicion the password has become known

- Never tell it to anyone… Never write it down

- Monitor your accounts regularly through online and mobile banking and account alerts, looking out for suspicious activity

- Keep apps and devices up-to-date with the most recent system updates

- Run anti-virus software and make sure your firewall is turned on

- Avoid unsecured wireless access points – like public WiFi hotspots

- Avoid clicking on links in unsolicited emails

Tips to Create Strong Passwords

- Make your passwords longer and stronger – at least 11 letters, numbers and special characters

- Use a mixture of upper and lower case letters, numbers and special characters (! @ # ?)

- Embrace the Passphrase

- Use a phrase that only you know that is at least 11 characters long.

- A strong password is hard to guess but should be easy to remember – if the password has to be written down it is not strong.

- Think of a word or phrase, then substitute the letters with numbers and special characters and mix case.

-

- “Serving members since 1951” = S3rv!nG@!(5!

- “Your signature is as good as gold” = Ur$G00#g0!#AU

-

What are the requirements to use Remote Deposit Capture (RDC)?

- You must deposit to a CFCU checking account

- The checking account must have been opened for 90 days

- No more than 3 NSF in a twelve month period

- No CFCU loan more than 30 days past due

- Business checking accounts are not eligible

- E-statements are required

- User must be at least 18 years of age

Is there a cost to use RDC?

There is no charge for Mobile Remote Deposit Capture. However, mobile carriers may charge for internet access and/or text messages. Please check with your carrier for any charges that may occur based on the usage of CFCU’s Mobile Remote Deposit Capture service.

When are checks deposited?

A check received before 3:00 pm CST will be deposited the same day. Any item received after 3:00 pm CST will be deposited the next business day.

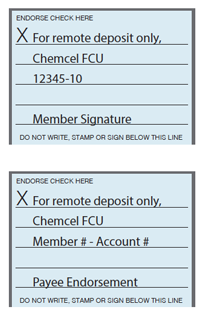

Is a special endorsement required for RDC?

Yes, a special restrictive endorsement is required for any item deposited through RDC. The failure to use the restrictive endorsement will cause the item to be rejected for deposit.

What checks are not eligible for deposit through RDC?

- Checks or items payable to any person or entity other than you;

- Checks or items drawn or otherwise issued by you or any other person on any of your accounts or any account on which you are an authorized signer or joint account holder;

- Checks or items containing obvious alteration to any of the fields on the front of the check or item, or which you know or suspect, or should know or suspect, are fraudulent or otherwise not authorized by the owner of the acct on which the check or item is drawn;

- Checks or items previously converted to a substitute check, as defined in Reg CC;

- Checks or items drawn on a financial institution located outside the United States;

- Checks or items that are remotely created checks, as defined in Reg CC;

- Checks or items not payable in United States currency;

- Checks or items dated more than 6 months prior to the date of deposit or;

- Checks or items prohibited by Chemcel Federal Credit Union’s current procedures relating to the Services or which are other wise not acceptable under the terms of your Chemcel Federal Credit Union account.

Do I need an e-mail address on file with CFCU?

Yes, a valid e-mail address is required if CFCU needs to contact you regarding a remote deposit.

When are funds available?

Generally, CFCU will use the normal Reg CC holding periods. However, CFCU reserves the right to use extended holding periods under certain circumstances.

Are there deposit limits?

The standard limit is:

- Max. Amount per Deposit: $ 2,000

- Max. Items per Deposit: 1

- Max. Deposit Amount per Day: $ 4,000

- Max. Items per Day: 10

- Rolling 30 day Amount Limit: $ 20,000

CFCU may alter these limitations on a per member basis.

What to do with a check after being deposited through RDC?

You agree to prominently mark the item as “Electronically Present- ed” or “VOID” and to properly dispose of the item to ensure that it is not represented for payment. You agree to secure each original check for a period of sixty (60) days after you have acknowledged acceptance and provide CFCU the original or full copy if needed to resolve a collection dispute.

Will all checks scan through RDC?

The RDC process relies heavily on the quality of the check and the ability to capture a clear image. Checks with a multi-color or com- plex background may not scan easily. A check where the written amount is not clear or overwritten may have difficulty during the scan process. A check that has a damaged MICR line at the bottom of the check will cause quality issues. In these cases the check will need to be mailed or negotiated at a branch location.

Are there other issues I should be aware of with RDC?

Yes, the information provided in the FAQs highlight some of the RDC requirements. You should thoroughly read the Remote Deposit Capture User Agreement you accepted when you signed-up to use RDC. (See other page for the Agreement)

You can also sign up for text message banking on your cell phone. This secured service is free-of-charge at Chemcel, but please check with your phone provider for their charges on text messaging.

Through text messaging, you can:

- Get account balances

- Transfer money

- Find out the last 5 transactions posted to your account

- And much more